Impressive Info About How To Develop Good Credit

Serving over 1 million customers worldwide.

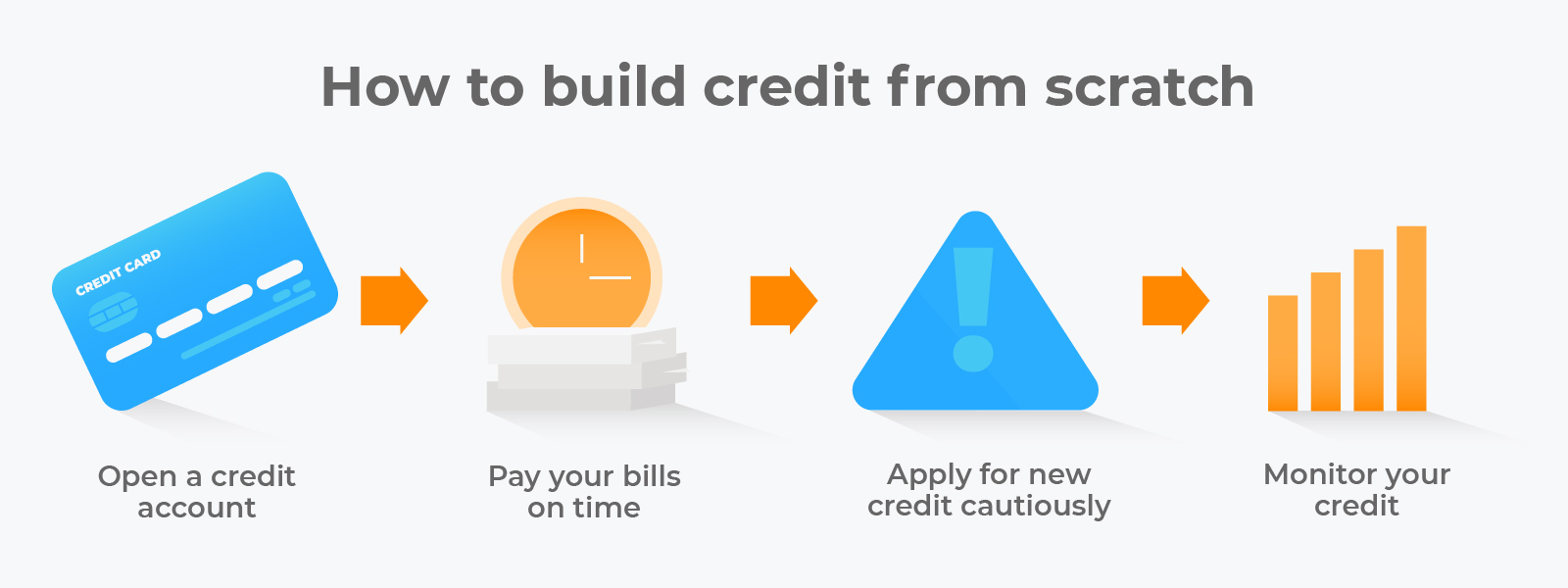

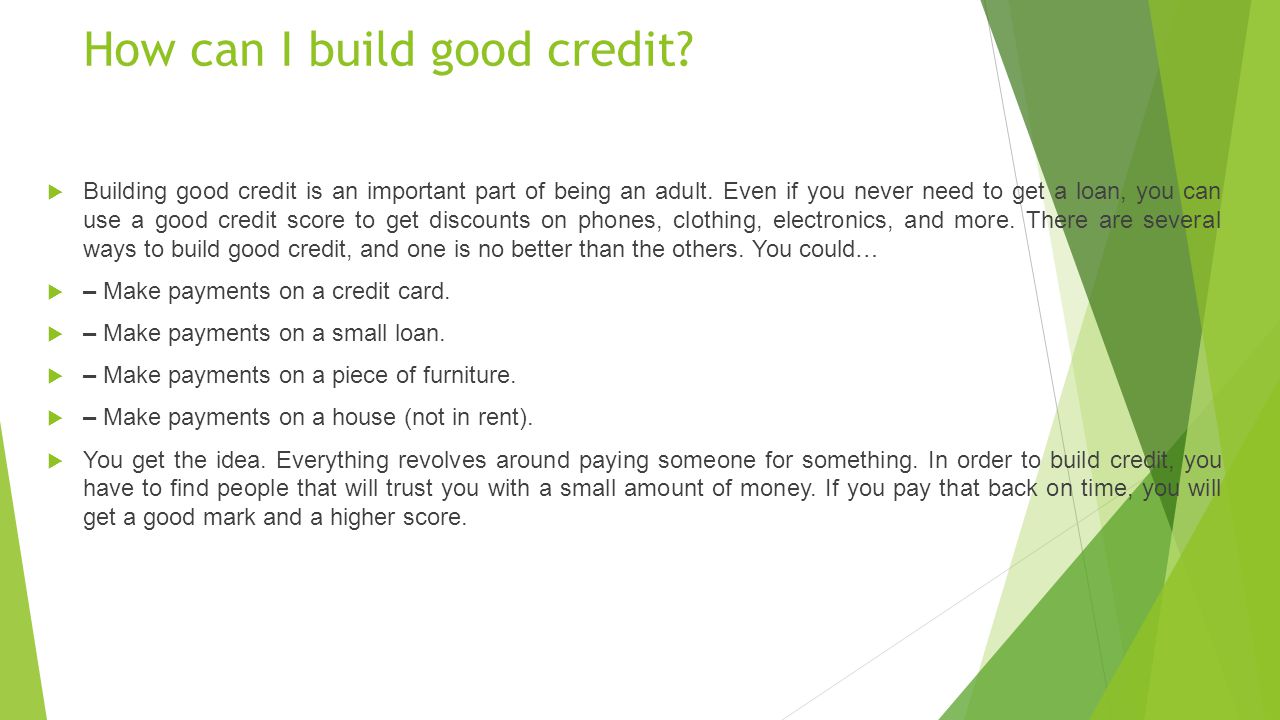

How to develop good credit. Elapsed time 0 seconds [00:00] building credit doesn't have to be difficult. That means you’ll earn $15 per year in statement credits. Keep your credit card balance to a minimum.

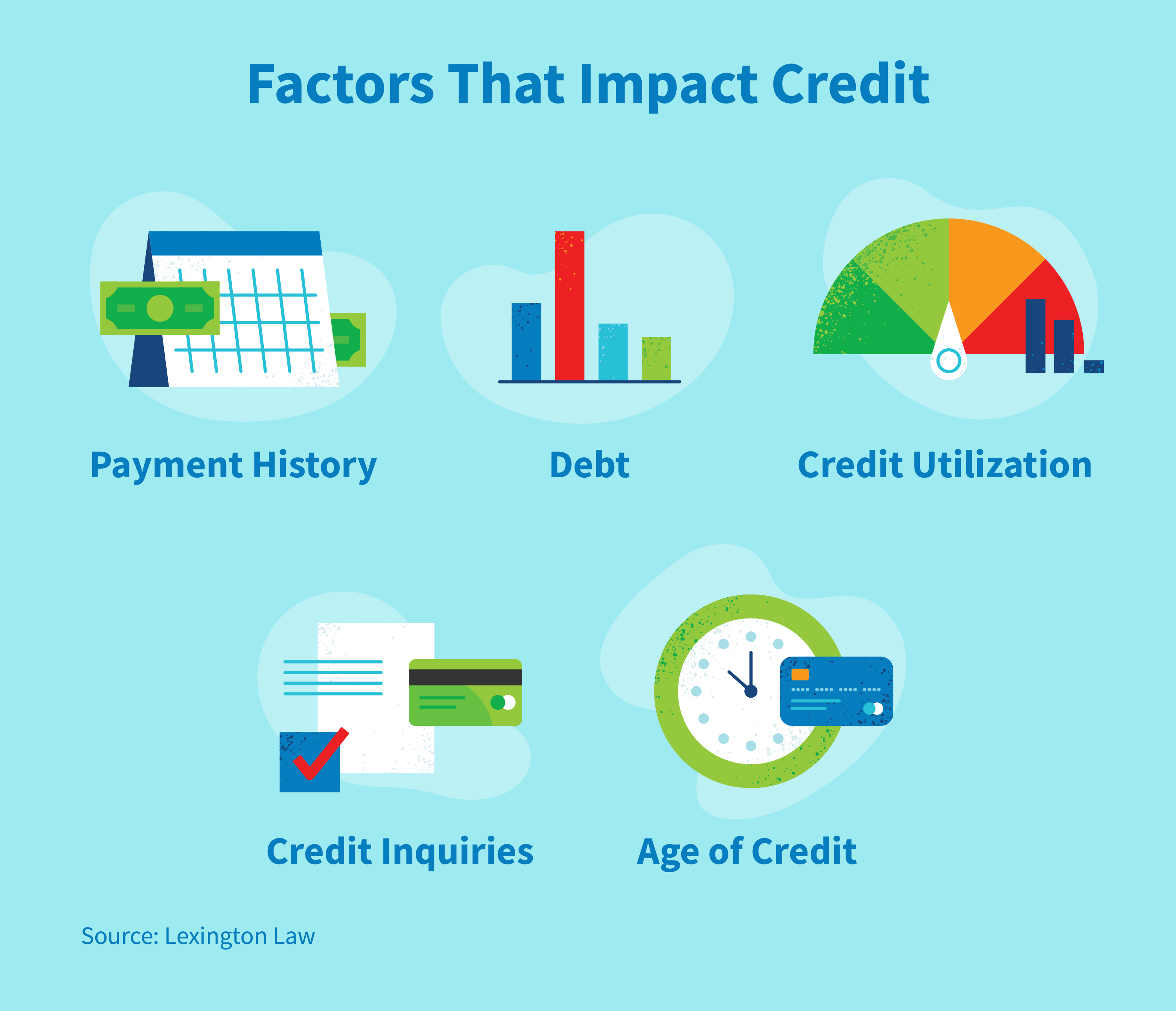

If your child is already a young adult who is ready to start building credit with a credit card, there are a few simple tricks you can teach them about maintaining. Ad learn 7 actionable tips to help rebuild your credit and improve your score. The length of your credit history is a key factor in determining your credit score.

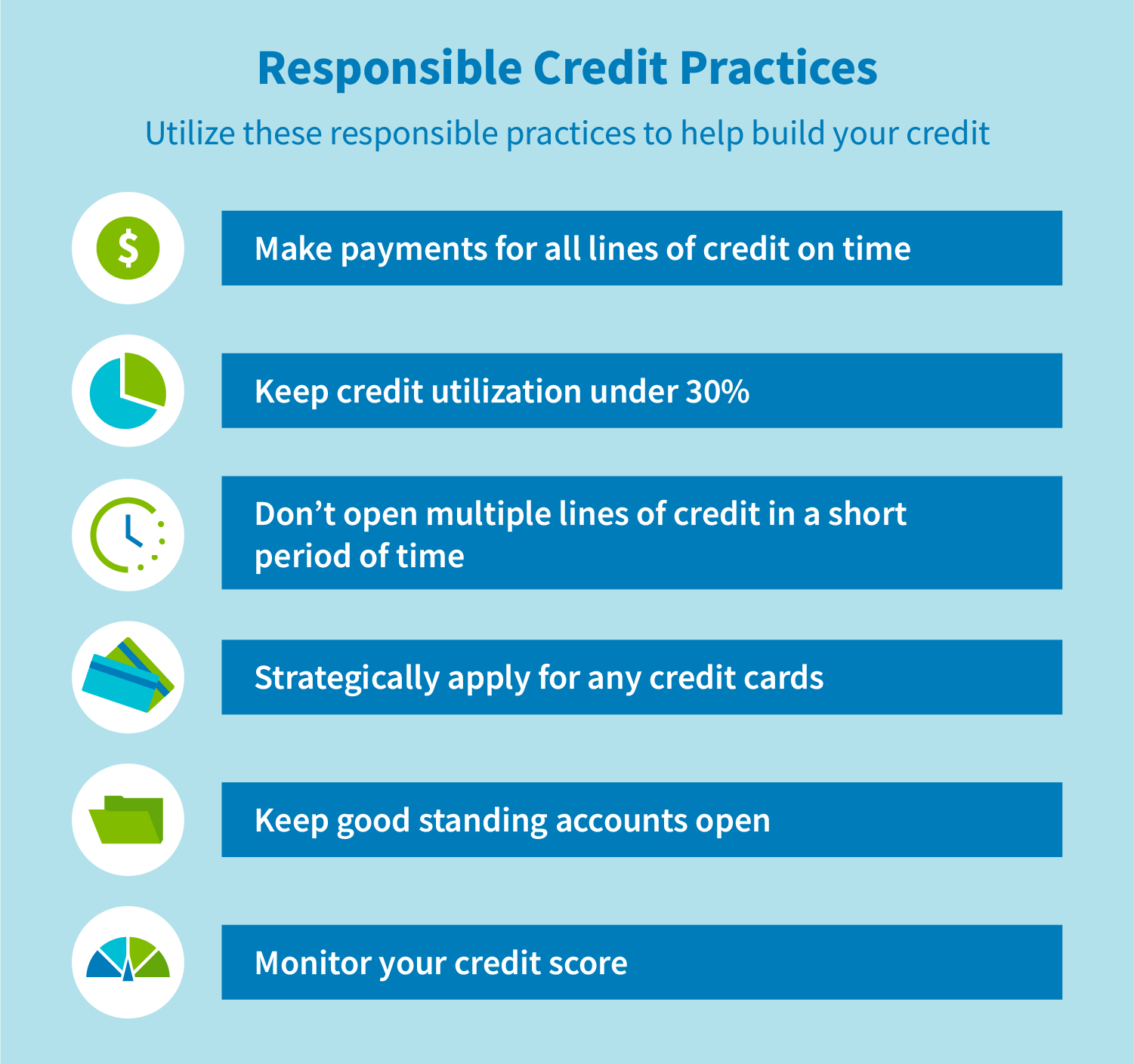

Lenders assume you don't plan to live within your means when you apply for a lot of. Get score planning & report protection tools now! If you’re not charging lots of money on your credit card, you won’t owe lots.

Get a secured credit card: You can use your credit card to make purchases, and they are very convenient. 7 best ways to build good credit.

13 hours agolet’s say you spend $1,500 in a year on your deserve edu mastercard for students. A credit card isn't a permission slip to buy things you can't afford. It does wonders for your payment history and also lowers the total amount.

How to build credit with no credit, best ways to build credit. If your credit history is very poor, getting a secured credit card is the best way to build good credit. Never pay late payment history is one of the most important factors that makes.

(1) use your phone bill, utility bills, and other monthly payments to build your credit history (2) report your rent payments to the credit bureaus (3) open a revolving. Only borrow what you can afford. The good news is that for those who don’t have a long credit history or who have a few blemishes, there are several things you can do to help establish good credit.

Borrowers need to demonstrate good credit scores to open accounts that can help build good credit scores. Although it seems simple, paying your lenders on time is going to be one of the biggest steps you can take to build a good credit score. Ad now's the time to put a powerful credit plan in place with transunion®.

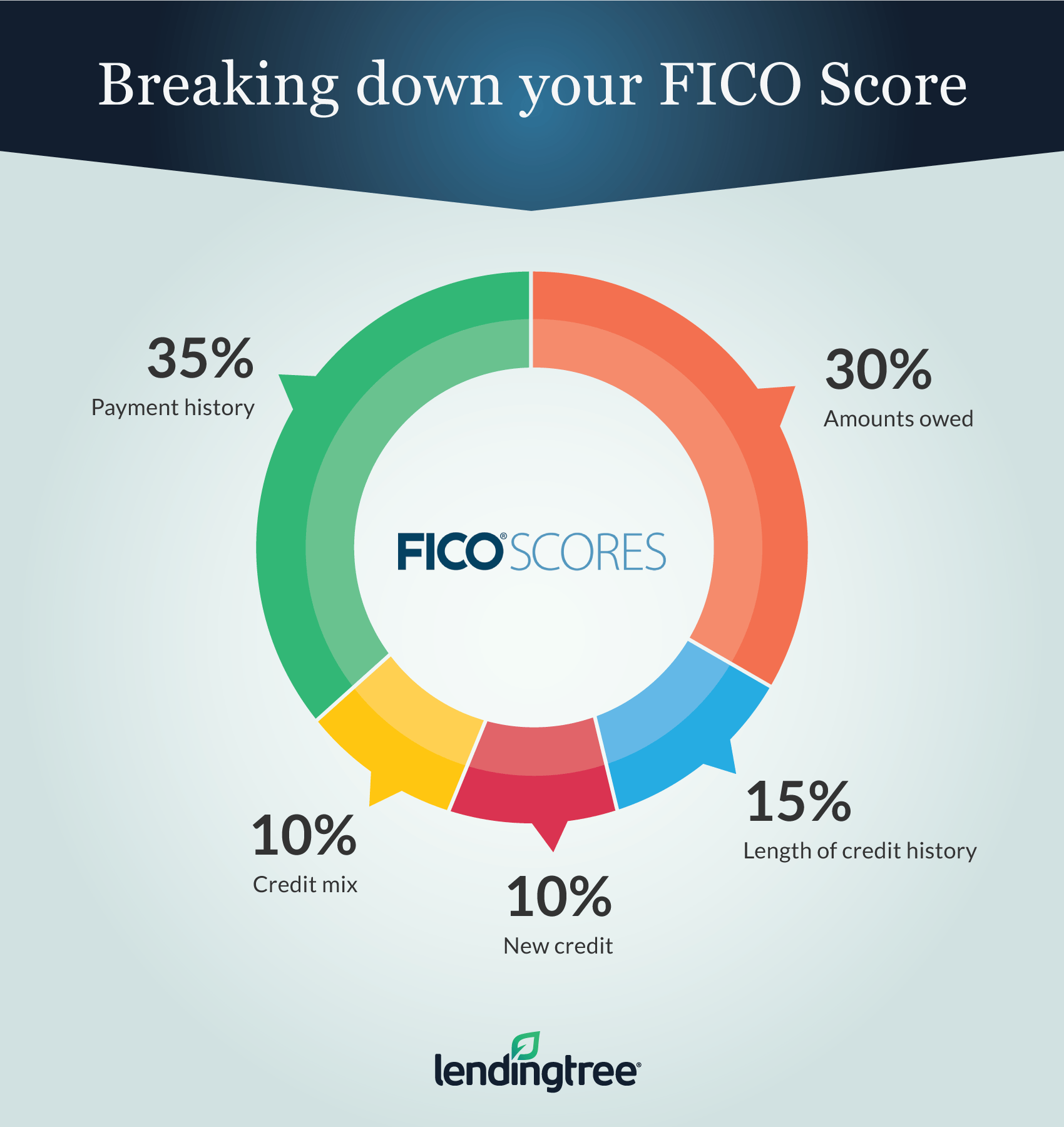

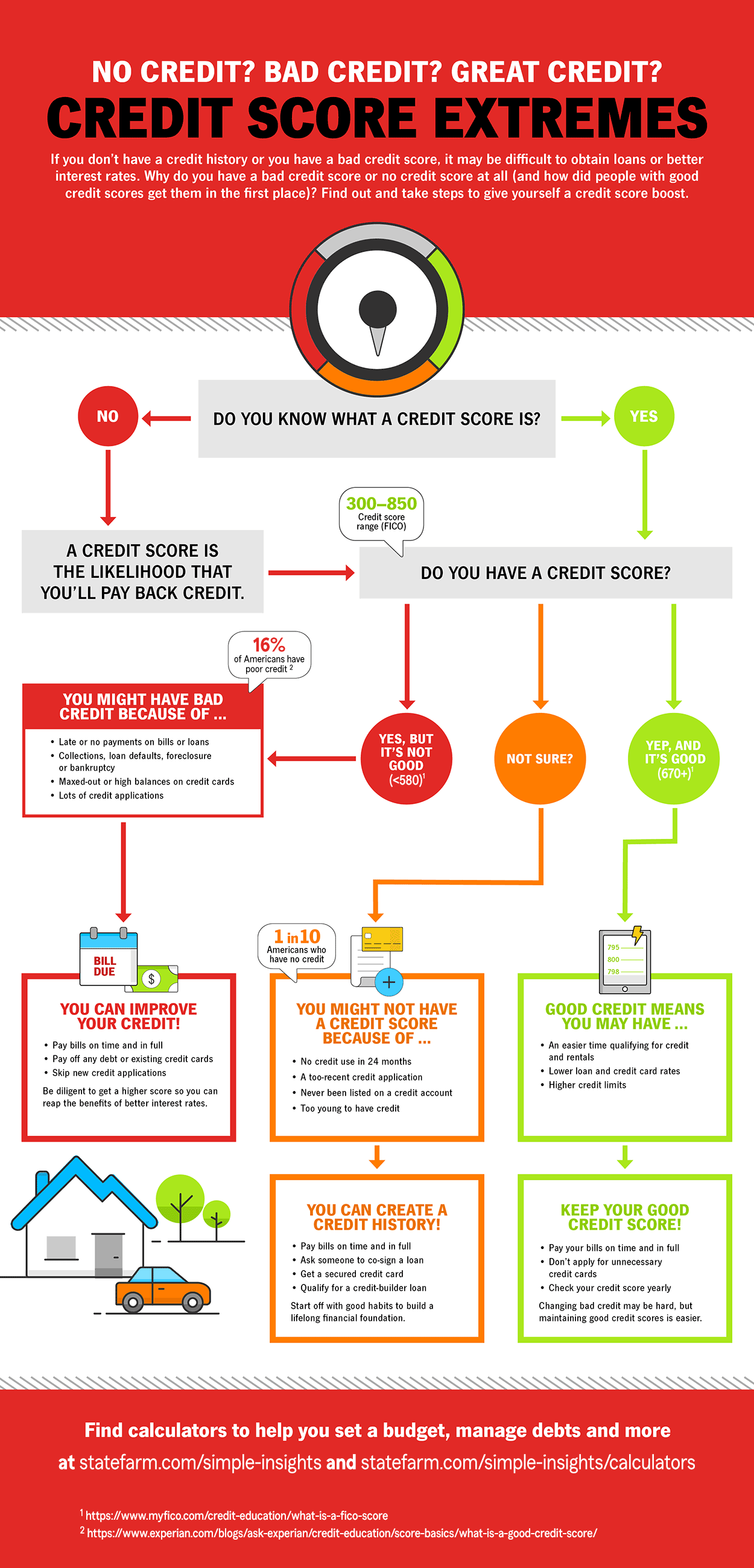

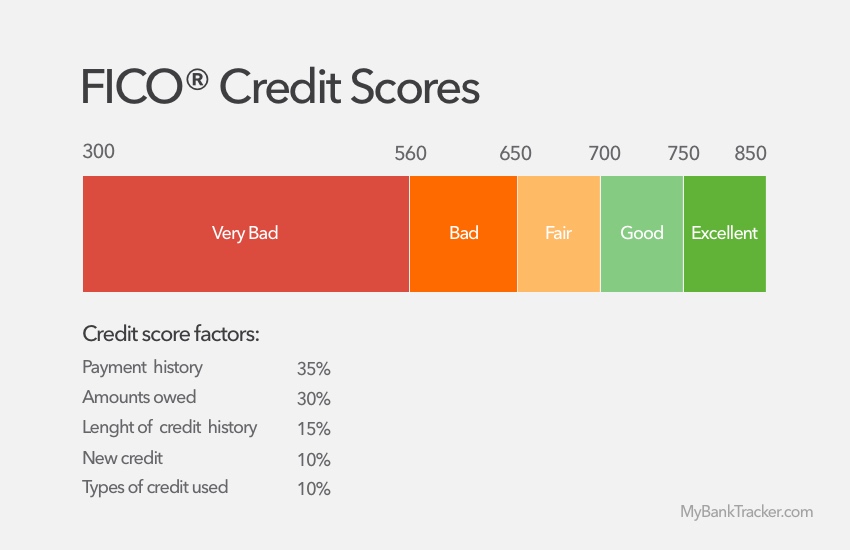

There are 5 main factors that make up your credit score. Paying off your revolving loans every month is a good financial habit that has a positive effect on your credit score. Understanding each of them is important to building or repairing your credit.

However, building a credit score is about responsible credit usage and positively impacting the. Get your credit score & equifax credit report. Start simple with the three c's:

![How To Build Credit [Infographic] | Credit One Bank](https://www.creditonebank.com/content/dam/creditonebank/articles/2021/11/A_Few_Good_Ways_to_Build_Credit_Infographic.jpg)