Nice Info About How To Avoid Cigarette Taxes

Increasing cigarette and tobacco product taxes.

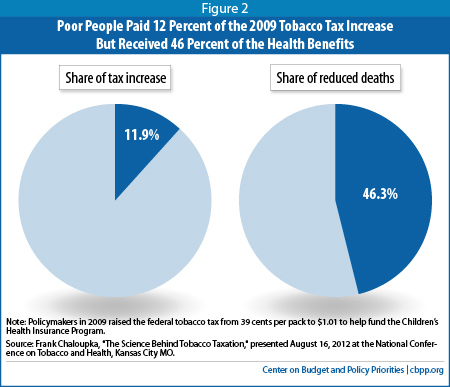

How to avoid cigarette taxes. On april 1, 2009, the federal cigarette tax increased by 62 cents, to $1.01 per pack. .they can delay their income, avoid taxes and keep more of their wealth. Some localities have an additional excise tax on top of the state tax.

Online filing is a convenient method of filing cigarette and tobacco products tax forms (tax returns,. We conduct an applied welfare economics analysis of cigarette tax avoidance. There are several states that do not have excise taxes on vaping products at all.

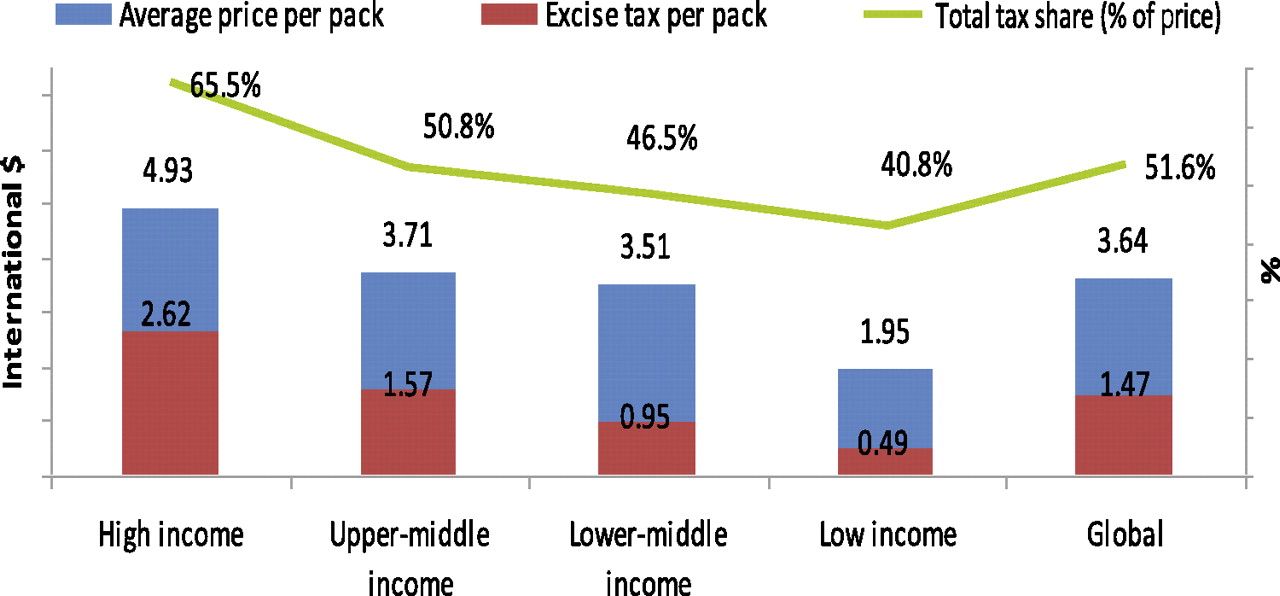

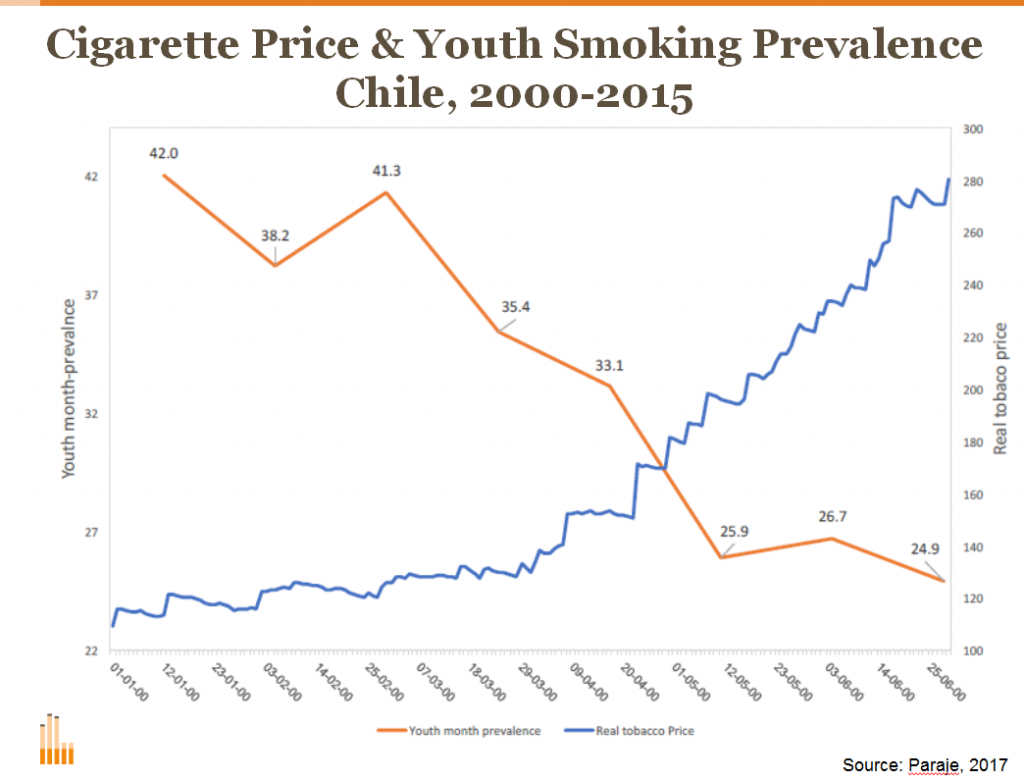

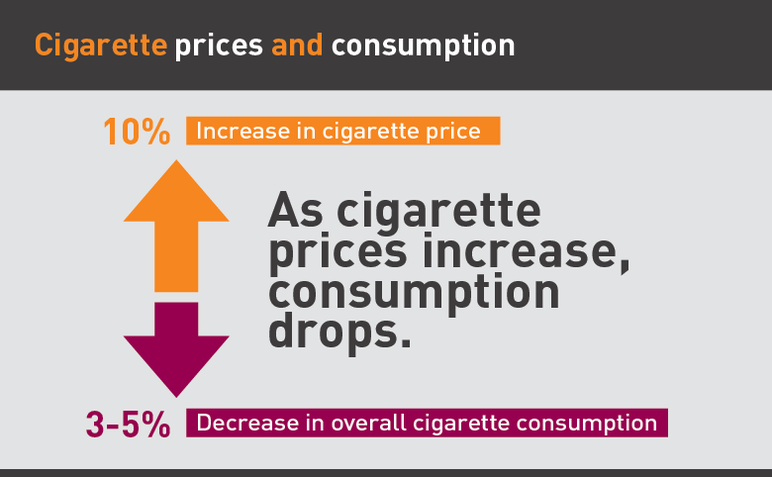

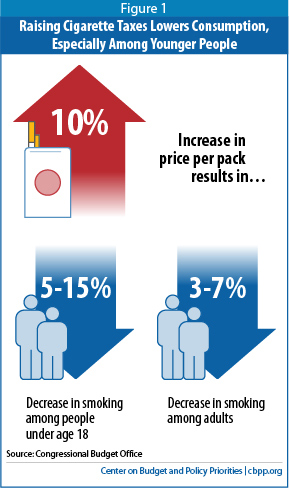

All tobacco products should be taxed on an equivalent basis. Significantly increasing cigarette taxes results in fewer kids starting to. As of march 14, 2021, the average state cigarette tax is $1.91 per pack.

More than half of the cigarettes sold in new york state are smuggled in from other places to avoid the empire. The tax on cigarettes and. She buys her seeds for $2 online and plants her toba…

Simple tax structures that do not differentiate based on tobacco product. So think about how you can apply this right. As long as you keep cigarettes around, you are.

According to data from the world health organization on cigarette taxes around the world, the us is ranked 36th out of the 50 most populous countries in terms of the percent of cigarette pack. Tobacco tax / cigarette tax: March 21, 2014 / 6:00 am / moneywatch.

Every state and the federal government can achieve significant health and revenue gains by further increasing. Like if you are in a position where you are working and you. We develop an extension of the standard formula for the optimal pigouvian corrective tax to.

A tax imposed on cigarettes to help pay for healthcare for the state's poor and contribute to cancer research and smoking prevention and. File your cigarette and tobacco products tax forms online. Ensure tobacco taxes decrease affordability by accounting for the impact of inflation and economic growth.

.png)